Property Values for Lyons Township Released

Tuesday, October 31, 2023

Cook County – Cook County Assessor Fritz Kaegi released the initial assessments of residential and commercial properties in Lyons Township.

“I strongly encourage property owners to review their reassessment notice to ensure their property characteristics and market value reflect their home,” said Assessor Fritz Kaegi. “It is important to understand that assessments in Cook County reflect market value over the last three years. My office will be hosting a virtual workshop to assist property owners and explain reassessments in their community.”

“We are here to help property owners. Residents are encouraged to attend a workshop to address their concerns regarding their reassessment notices. The workshops will provide an opportunity to determine if an appeal should be filed, an overview of the online application, and teach homeowners about available property tax savings,” said Lyons Township Assessor Patrick Hynes. A full list of Lyons Township events can be found at lyonstownshipil.gov/assessor.

Appeals for Lyons Township can be filed until Monday, November 27, 2023.

To learn more about property assessments and appeals, watch our upcoming virtual workshop live on Facebook or YouTube scheduled on Monday, November 13, 2023 from 6:00PM - 7:00PM. View all of our upcoming events at www.cookcountyassessor.com/event-list.

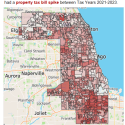

The Assessor’s Office reassesses one-third of the county every year. In 2023, the south and west suburbs of Cook County are undergoing reassessment. Lyons Township contains all or a portion of the following municipalities within its borders: Village of Bedford Park, Village of Bridgeview, Village of Brookfield, Village of Burr Ridge, City of Countryside, City of Hickory Hills, Village of Hinsdale, Village of Hodgkins, Village of Indian Head Park, Village of Justice, Village of La Grange, Village of Lyons, Village of McCook, Village of Riverside, Village of Summit, Village of Western Springs, and Village of Willow Springs.

When a property is reassessed, the property owner is mailed a Reassessment Notice. The Reassessment Notice reflects the estimated fair market value based on sales of similar properties over the past three years. The notice also contains important information such as the property’s characteristics, neighborhood code, and past assessments. An increase in a property’s assessment does not cause the same increase in the property owner’s taxes.

After a township undergoes reassessment, a valuation report is released that provides details on residential, commercial, and multi-family reassessments. Property owners can use these reports to gain insight on how property assessments work, learn about the real estate market in their specific neighborhood, and compare the median to their property value. The Valuation Reports for Lyons Township can be found at: cookcountyassessor.com/valuation-reports.

How do assessment appeals work? Property owners are given an opportunity to appeal their assessment if the property characteristics listed on an assessment notice are incorrect, or if the estimated market value of a property is significantly more than what it could sell for in the current real estate market.

Residential Properties

Residential assessments are based on recent sale prices of similar properties. To get a better picture of the real estate market in Lyons Township, the chart below demonstrates median sale prices over the last five years. The median sale price in 2022 for single-family homes was $410K, $169K for condos, and $357K for small apartment buildings.

The Assessor’s median market value estimate for single-family homes is $346K, for condos $183K, and $330K for small apartment buildings.

Read the Full Residential Valuation Report

Commercial Properties

Commercial property assessments are calculated by determining a property’s use, estimated income, market-level vacancy, collections loss, and expenses. Applicable real estate operating expenses include property taxes, insurance, repair and maintenance costs, and property management fees. The varying property tax rates throughout the south and west suburbs were accounted for in operating expense ratios.

To learn more about how commercial reassessments work, read the full Commercial Valuation Report. Commercial and multifamily property owners can go a step further and locate their property on a methodology worksheet that contains the data used to assess their property.

Read the Full Commercial Report