Homeowners: Are you missing exemptions on your property tax bill?

Tuesday, August 24, 2021

How to apply for Certificate(s) of Error

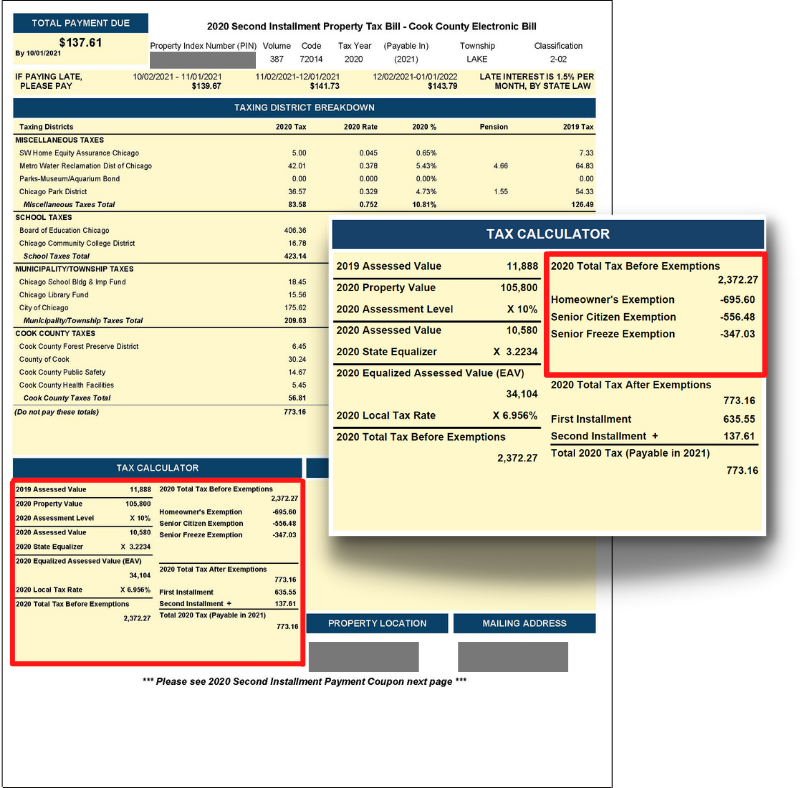

COOK COUNTY – As homeowners in Cook County receive their 2020 Second Installment Tax Bills (tax bill) in the mail they are encouraged to look at the bottom left corner to ensure that the correct exemption(s) are applied.

If a homeowner believes they are entitled to an exemption that is not reflected on their tax bill, they can apply for what is called a Certificate of Error. The Certificate of Error process provides homeowners an opportunity to redeem missing exemptions for up to three years in addition to the current tax year. Homeowners can now apply for 2020, 2019, 2018, and 2017 tax years.

Certificate of Error applications with copies of supporting documentation can be filed online, by mail, or in person. Homeowners are strongly encouraged to apply online as representatives from the Assessor’s Office can easily provide updates on the status of applications.

Please see the full list of property tax exemptions administered by the Assessor’s Office here: cookcountyassessor.com/exemptions.

This year, many exemptions auto-renewed to make the process more convenient for homeowners. In addition to the Homeowner and Senior exemptions, the Assessor’s Office processed auto-renewals for the “Senior Freeze”, Veterans with Disabilities, and Persons with Disabilities exemptions.

In total, more than 1.1 million exemptions were auto-renewed, which provided millions of dollars in tax relief to homeowners in Cook County.

As a reminder, homeowners are responsible for paying the entirety of the tax bill to the Cook County Treasurer’s Office by October 1, 2021. If the Certificate of Error application is granted, either a corrected tax bill or a refund for the difference will be issued.

Please download a copy of the new brochure, How to Apply for Missing Property Tax Exemptions that is available in six languages.

How to contact the Assessor’s Office:

Send Message: www.cookcountyassessor.com/contact

By Phone: (312) 443-7550

Facebook: www.facebook.com/CookCountyAssessorsOffice

In-Person: www.cookcountyassessor.com/appt