Cook County Assessor Releases Property Tax Data and Simulation Software Code

Thursday, December 1, 2022

Property tax database available for policy analysts, journalists, and civic technology enthusiasts

COOK COUNTY – Over $180 billion in property taxes collected from every property in Cook County – from Ford Heights to Chicago to Winnetka – can now be analyzed with software code created by the Cook County Assessor’s Office.

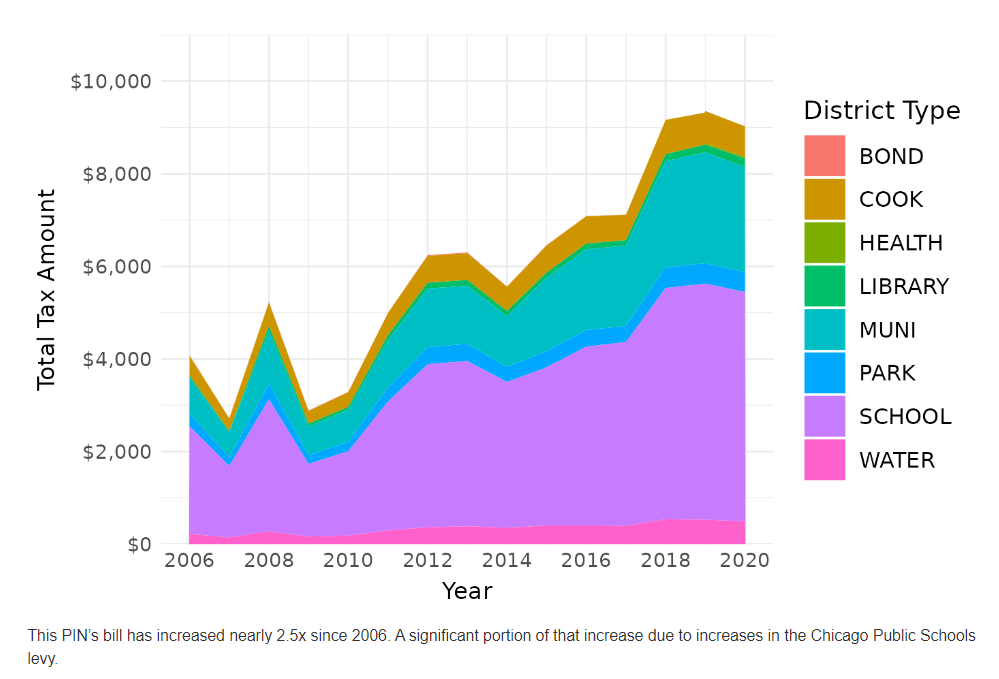

The Property Tax Simulator, or PTAXSIM, is a software code package implemented in the coding language R and designed to recalculate changes to Cook County property tax bills. It uses real assessment, exemption, TIF, and levy data to generate historic, line-by-line tax bills for any Cook County property from tax years 2006 to 2020 (for bills issued from 2007 through 2021). PTAXSIM allows the user to recalculate and analyze single or multiple historic tax bills simultaneously.

The Property Tax Simulator, or PTAXSIM, is a software code package implemented in the coding language R and designed to recalculate changes to Cook County property tax bills. It uses real assessment, exemption, TIF, and levy data to generate historic, line-by-line tax bills for any Cook County property from tax years 2006 to 2020 (for bills issued from 2007 through 2021). PTAXSIM allows the user to recalculate and analyze single or multiple historic tax bills simultaneously.

The Assessor’s Data Department created the database by extracting already-public tax levy and rate data published by the Cook County Clerk, then combined it with previously unpublished data.

“This is the first time that the data used to create tax bills in Cook County has been put together in one place,” said Cook County Assessor Fritz Kaegi. “Researchers and policymakers can now use the data to analyze the whole system of appeals, exemptions, and tax levies – an unprecedented resource for academics, journalists, and policymakers.”

Researchers can analyze 15 years of tax data (tax years 2006-2020) including:

- Over $170 billion in property tax dollars was levied to fund over 1,800 taxing districts. Taxing districts determine how many property tax dollars to collect from taxpayers every year.

- Over $13 billion in additional property tax revenue for over 600 TIF districts. TIFs are established by municipalities to fund development.

- Tax rates range from below 2% to over 35%. Tax rates are calculated by the Cook County Clerk using assessed values, exemptions, the state equalizer, and property tax levies.

- Over 1.8 million parcels, with data about assessed value and exemptions applied by the Cook County Assessor and assessed value adjustments determined by the Cook County Board of Review.

Given some careful assumptions and data manipulation, PTAXSIM can provide hypothetical, but factually grounded, answers to counterfactual historical scenarios. The software documentation contains example scenarios that show how tax bills might have changed if, for example, a TIF district did not exist if exemption amounts increased, or what could have happened if appeals did not occur.

PTAXSIM is an R package that can be downloaded here: www.cookcountyassessor.com/property-tax-simulator-tool. The Assessor’s Office Data Department welcomes questions at Assessor.Data@cookcountyil.gov.