Assessor Kaegi Celebrates Passage of Bill Expanding Access to Property Tax Exemptions for Senior Citizens, Veterans, and Persons with Disabilities

Monday, April 18, 2022

Cook County- Assessor Fritz Kaegi today celebrates the passage of SB1975, a bill in the Illinois General Assembly that creates automatic renewal options for the persons with disabilities and veterans with disabilities exemptions and expands income verification options for the low-income senior citizen exemption.

SB1975, which passed both the Illinois House and Senate with near-unanimous bi-partisan support, will amend the Property Tax Code so that a person who has been granted a Persons with Disabilities Exemption does not need to reapply for the exemption every year, as is the case now, if the applicant provides documentation that they have a qualifying disability, such as a Social Security benefits letter, letter from a medical provider, or Class 2 disability card issued by the State of Illinois.

Exemptions for those receiving the Veterans with Disabilities Exemption will auto-renew if the qualifying veteran is deemed permanently and totally disabled by the U.S. Department of Veterans Affairs.

“This is a win for good government,” said Assessor Kaegi. “These changes to the law will make it easier than ever for persons with disabilities and seniors on fixed incomes to receive the property tax savings they deserve.”

SB 1975 also provides for the surviving spouse of a deceased veteran to continue to receive the exemption earned and applied for by the veteran.

The bill’s chief sponsors are Senator Robert Martwick and Representative Stephanie Kifowit.

“I am thrilled that the Democratic members of the House and Senate were able to work together to achieve real and comprehensive property tax relief,” said Sen. Martwick. “I would especially like to thank Rep. Kifowit and Rep. Yingling for their work on this important legislation and I would like to thank the Assessor’s Office for their important contribution as well.”

"I appreciate the support of my colleagues in the General Assembly and Senator Martwick in getting this bill passed and sent to the Governor's desk,” said Representative Kifowit. “SB 1975 provides needed relief from red tape for seniors, veterans, and persons with disabilities. Creating more access for veterans, people with disabilities and low-income seniors is part of what we are elected to do. I appreciated working with Assessor Kaegi and his staff to put these long-overdue improvements into the law."

Since 2019, the Assessor’s Office has auto-renewed approximately 280,000 senior exemptions each year, with approximately 45,000 seniors required to re-apply as part of an audit and verification process. The auto-renewal and audit process reduces costs and has significantly reduced the number of seniors who do not receive the exemptions they deserve.

“Renewing this exemption automatically removes a needless barrier for people with disabilities and helps enable them to live in housing of their choice in the community,” said Mary Rosenberg of Access Living, an advocacy agency for and led by people with disabilities.

“Older adults in Cook County will face a lighter administrative burden in keeping their housing affordable under this law, said Adam Ballad, associate state director of AARP Illinois. “This will help more of them remain in their homes and communities.”

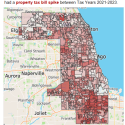

“More accurate assessments and easier-to-access exemptions have reduced tax bills for residents around Cook County, said Assessor Kaegi. “I look forward to Governor Pritzker signing this bill into law, which will help ease unnecessary burdens for over 100,000 low-income seniors, over 18,000 persons with disabilities, and many veterans in Cook County,” Assessor Kaegi said.